Let’s start with a few surprising facts about currencies that you may not be aware of.

The Dollar is not backed by anything. The US officially came off the Gold Standard (where the dollar was backed by gold) in 1971, although temporary breaks between the dollar and gold happened several times in previous decades. When the dollar permanently broke away from gold is when the dollar officially became a fiat currency. A fiat currency is a currency issued by the government and backed by the trust that it is worth what the government says it is. The definition of fiat is “by decree.”

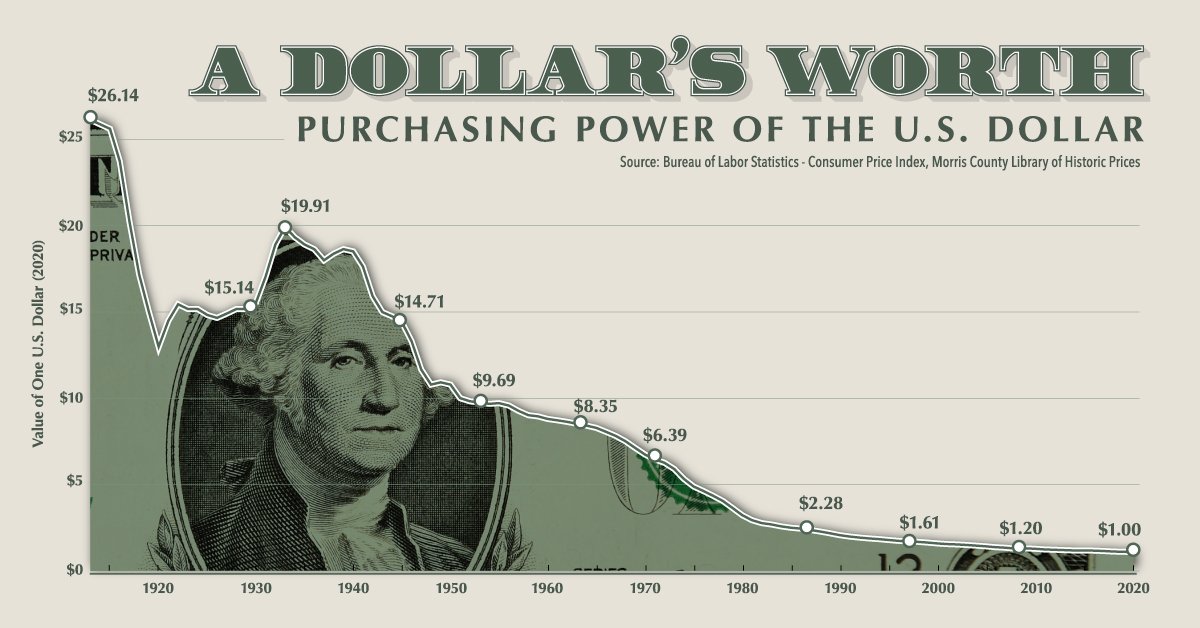

The dollar has been losing purchasing power consistently since its inception.

Fiat Currencies have an average lifespan of 27 years.

World reserve currencies have an average lifespan of 80-110 years, and the dollar has been the world’s reserve currency for about 103 years depending on which resource you use.

As you can see from these few examples, currencies that are issued by governments do not have the best track record. Fiat currencies all end up collapsing at some point in time because of centralized authority over the money supply. This has been happening for hundreds of years, dating back to when cultures used seashells for exchange. For example, wampum shells used to be used as currency in parts of the Americas, Africa, and Asia in the 1600s. These shells were fairly rare to these cultures and were difficult to come by, so they worked well for retaining value. This type of currency works in small societies, but eventually the New England colonists arrived with greater technology that allowed them to drill for more shells at a much faster pace than the more primitive societies they encountered. They used these mass-produced shells to purchase furs and items from these indigenous populations until the market was flooded with new shells. The mass production and centralized authority that New England brought to this economy devalued the shell currency and the colonists were able to buy most of the goods the indigenous population had worked to create. This more primitive form of hyperinflation lead to the collapse of the shell currency and had to reset to a more sound or “hard” money that newer technology couldn’t mass produce. This refers to money like gold, which is hard to create and extremely difficult to replicate. Gold makes for much better or sounder money than seashells, salt, or cattle, which were all used as currency at some point in history.

During the Gold Standard era, the dollar was backed by gold, meaning you could take your cash into a bank and redeem it for its value in gold. With the dollar pegged to the value of gold, governments were held to a certain level of spending as they could not print more money than they had gold in reserves. In today’s economy, the dollar, along with every other global currency, is fiat money, as it is no longer backed by gold or any other real commodity. This allows governments to print money on a whim, which dilutes the purchasing power of everyone’s money. The dollar began to come off the gold standard in part to finance both world wars (and all the wars since) along with new technology such as the telegraph which made moving money much simpler and faster than sending and verifying gold for each transaction. So, the US, and eventually the world, broke away from a dollar pegged to gold system and we now have 160+ fiat currencies around the world. This allowed transactions to happen much more seamlessly, but it also changed the way countries worked around budgets. The world started to operate on credit and easy money instead of money limited by a commodity. This drastically changed the way governments financed everything including wars, company bailouts and financial crisis. We used to vote on wars and buy war bonds or raise taxes to support a war, but now we endlessly finance them because the money is created with no taxes being taken. Instead, money is printed without the knowledge of the public. It is much easier to get the public on board with these expensive endeavors when we don’t directly get taxed for them. What we fail to understand is that there is a tax being taken, and that is the tax of inflation.

With no asset to peg our money to, the government of any country prints money whenever they are in a pinch, or even when politicians need to win an election. For instance, when faced with a possible recession, it is a much easier decision to print money to “save” the economy in the short term in order to get reelected, while leaving the mess to fall on another leader in the future. It is very difficult to win an election by cutting spending and letting the economy correct itself. For hundreds of years, history has repeated this mistake, until the game eventually ends, and a new money is introduced.

I believe we may be nearing the end of the dollar as a world reserve currency. However, to estimate the time frame for the collapse of the dollar is impossible. It could be 5, 10, or 50 years away, but every time we print more money, we bring that timeline closer. We printed over 700 billion dollars in 2008 during the Great Financial Crash and over 6 trillion dollars in the Covid-19 response. If we have another shock to the system, how much money will need to be printed to avoid disaster, and how much more fragile will that ultimately make the system and economy? There is a point in time when the national debt created by this money printing becomes impossible to pay back because just the interest rates alone on the debt are too high to pay back. According to https://www.usdebtclock.org/, we are currently at $34 trillion dollars in debt. This is not something that can go on forever.

Why should you care about the debt of the US and how does money printing affect you? To be brief, it steals your time and money by way of inflation. In the next article, we will dive into inflation, which is what money printing creates. I promise that this is not to be doom and gloom, as I know it sounds that way. This is meant to be more of a realistic look at what is happening in the world and how this new asset, Bitcoin, may be stepping in to help solve some of these large global issues. We need to know the problems we face in order to start looking for a solution. Although there is a lot of bad, there is also a lot of hope in the near future too. It comes from people seeing potential future problems and building new ways to mitigate or solve them.

You can find Part 3 of the series about Inflation here.