In the preceding articles, we discussed the inflationary monetary system in which we operate and highlighted how Bitcoin differs from any fiat currency in existence today. Now, we will delve into how these two distinct currencies influence decision-making for individuals and societies by examining the concept of time preference.

Time Preference

Time preference refers to how far into the future people tend to look when making decisions, as they constantly weigh choices that trade present value against future outcomes. This concept applies to both individuals and society at large. A high time preference indicates that a person makes decisions favoring immediate benefits, potentially sacrificing future value. Conversely, a low time preference reflects a more long-term focus, involving sacrifices in the present for future gains.

To illustrate, consider a simple scenario: someone offers you a donut. In deciding whether to accept it, you weigh the immediate pleasure against the potential impact on your future health. Taking the donut signifies a high time preference, while declining it, considering future health, indicates a low time preference. Similar considerations apply to significant choices, such as starting a 401k or saving for a child’s college fund, where delaying gratification in the present promises greater benefits in the future. Lowering time preference is generally desirable for personal well-being and societal progress. Think about your health, your family, and your career and what sacrifices in the present you are willing to make in order to add value to these areas in the future. What situations in your life have you lowered your time preference for?

Fiat vs Bitcoin

Different types of money play a large role in individual and society time preferences. The financial environment of debt and fiat money printing has increased everyone’s time preference without us being aware of it. Despite being told that a 2% inflation rate is necessary for economic growth, the implications on time preference are often overlooked. If your money is inflating away at 2% per year, then every year you have to work 2% longer (assuming your wages stay the same) just to continue to keep the same life you had. Over ten years, this adds up and most people’s wages aren’t going to keep pace. The unprecedented money printing in 2020, coupled with ongoing efforts, such as the Bank Term Funding Program (BTFP) that was set up in 2023 to backstop the banking sector when Silicon Valley Bank went under, and the funds being sent to support the war in Ukraine, exacerbates the situation, leading to higher inflation rates. Inflation reached 7-9% (true inflation was probably closer to 15-20% as you probably had a sense of this when you went to the grocery store, bought gas or tried to buy a house or car in the last couple years) which means that without any value being created in society, your money or purchasing power was diluted by that percentage. Now you have to work even more hours to get that back. Your time is essentially being stolen from you. How do you think this changes people’s time preference? This constant devaluation of currency forces people into faster and riskier financial decisions, exemplified by phenomena like the meme stock and NFT crazes (here are two brief articles explaining the meme stock hype and how people spent their stimulus checks from Covid-19: 1. Meme Stock Article 2. Stimulus Check Article). We go out to eat more because we have less time to cook, since we are working more hours, which in turn causes our health to decline. We get less time with our kids and feed them quick snacks which affects their health and well-being. We forget about saving for the future because it is hard enough just to pay rent. It is all linked together by the money. The more people struggle to get by, the more their time preference is raised. People cannot think about the future when we are just trying to get to the next paycheck.

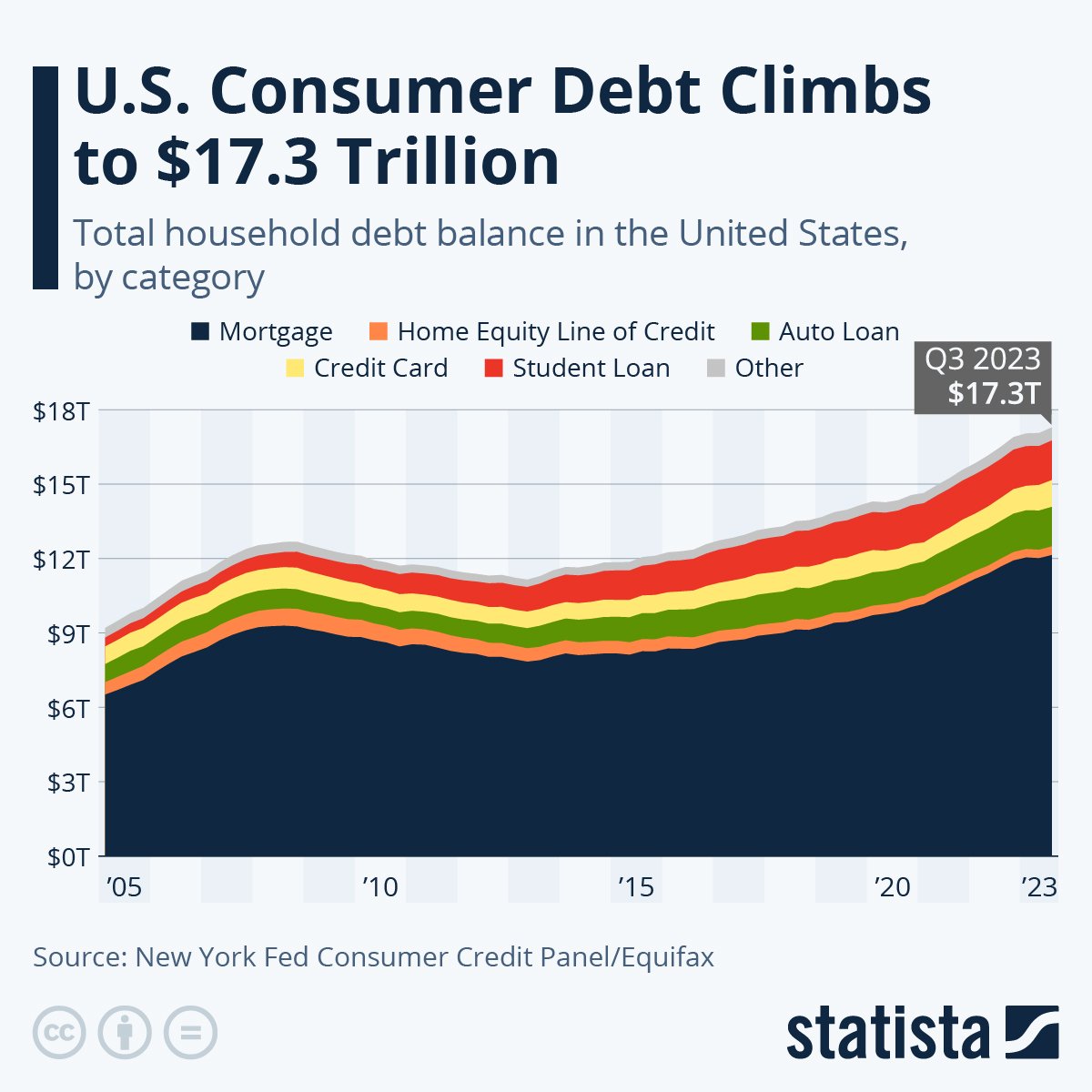

It is no coincidence that consumer debt is at all-time highs and savings are trending lower and lower.

Now it is time to think about your financial health in a different way and potentially get a new perspective on a money that takes back all the time that has been stolen.

Bitcoin is arguably the soundest and best form of money that mankind has ever known. It brings with it the potential to restore time preference to society. Bitcoin is a money backed by energy and mathematics, not by a small group of people. It cannot be printed freely, and it is out of the control of any single entity. There is a fixed supply of 21 million coins which means that the price of everything against this asset will fall to its free market cost over time. Up until this point we have lived in a world where money was infinite, while all our resources are finite. In this environment prices have to rise in order to keep the system going, despite all the technological progress. A few questions to ask yourself in order to understand this are why is it so much easier to build a house, but yet all house prices and rent keep going up? Why is it more expensive to go to college even though all the same information is online? Why is food more expensive even though we can grow, harvest, and produce it more quickly and cheaply than ever before? The answer is because we inject more money into the system to keep it from collapsing and the more there is in the system the more the prices of goods and services must go up. We are creating money faster than we are producing goods and services. This also means assets are used to preserve wealth, such as houses, stocks, and artwork, instead of the currency. Society puts a monetary premium on assets because they are being used as a store of value as the currency is no longer providing us with the ability to save. Holding dollars or any other fiat currency is like holding a melting ice cube. It is no wonder why wealthy individuals and large corporations are buying up houses to preserve wealth, which continues to price the younger generation out of the housing market.

Bitcoin flips this on its head. The 21 million supply cap changes the equation to “everything divided by 21 million.” This paradigm shift takes away or at least significantly reduces government manipulation of markets, such as subsidies and bailouts because they cannot print more Bitcoin. This has the potential to bring back free market competition and technological progress which are naturally deflationary forces, meaning prices of everything will fall in terms of Bitcoin over the long run. In this sense Bitcoin can be used as the main way to preserve savings and purchasing power instead of all these other assets.

This can be tricky to wrap your head around because we have never lived in a world where that was possible but think what that would do for the individual and society. If prices were always falling in relation to the money we used, everyone’s time preference would change. It would naturally lower societies’ time preference as a whole. If we knew our purchasing power was appreciating in value, people would be more incentivized to save. This would allow us to allocate more capital to productive investments. It would give us the security to think 5, 10, 30 or even 100 years into the future instead of just worrying about next month’s rent. Imagine how homelessness, crime, and civil unrest would change as prices got cheaper. Think of the implications on citizens health when food becomes affordable again and how that would change the healthcare system over time. Architecture and artwork would be built to last instead of being thrown together as quickly as possible. People would have time in their lives again to spend with their family and loved ones instead of working two or three jobs which would drastically improve mental health.

Of course, this is a theory that would need decades to play out. However, with a small individual example, we can see how true this could become. If you had a gold coin and a thousand dollars, which one are you going to spend first (assuming you could spend the gold coin as freely as the cash)? The gold coin will most likely hold its value or even increase in value over the long term while we know the dollars are decreasing in value, so we are incentivized to hold on to the better store of value. If we do spend the gold coin, it will most likely be on something that is going to provide lasting value or has the potential to increase our overall wealth. As we play this out with a currency like Bitcoin, where it has the potential to grow exponentially, we already see people making the long term decisions to hold onto these coins for longer and longer periods, as shown by the chart here. People using hard money tend to prioritize saving over spending. This will never influence every individual, but it could potentially change the way society looks at money over the long run.

In imagining a world where currency appreciation is the norm, one can foresee positive changes in societal behavior. Lower time preference on a global scale could lead to increased savings, productive investments, and enhanced well-being. Bitcoin, with its unique properties, presents an opportunity to reverse the trend of rising time preferences and, consequently, offers a potential solution to societal challenges.

Final Thoughts

The belief that inflation is essential for economic growth holds true within our current system. However, an alternative system, anchored in Bitcoin, prioritizes savings and abundance for humanity. Contrary to the notion that saving money impedes economic progress, a Bitcoin-based system promotes a lower time preference, encouraging prudent spending, emergency preparedness, and support for meaningful causes. Bitcoin aligns with the deflationary aspects of technological progress, challenging the traditional narrative that inflation is indispensable. In this context, saving money becomes a strategy for acquiring higher quality goods, waiting for prices to drop, and fostering sustainable growth. While fiat incentivizes debt, inequality, and growth by any means necessary, Bitcoin incentivizes savings, abundance, and healthy growth—a potential pathway to a more equitable and prosperous future.

For further exploration of these concepts, the book “The Price of Tomorrow: Why Deflation is the Key to an Abundant Future” by Jeff Booth is recommended. The author argues that our current inflationary monetary policy conflicts with the natural deflationary trajectory of technological progress, emphasizing the need for a monetary system that aligns with these advancements to create a flourishing and healthy future. Fix the money, fix the world.

The next article in the series can be found here.